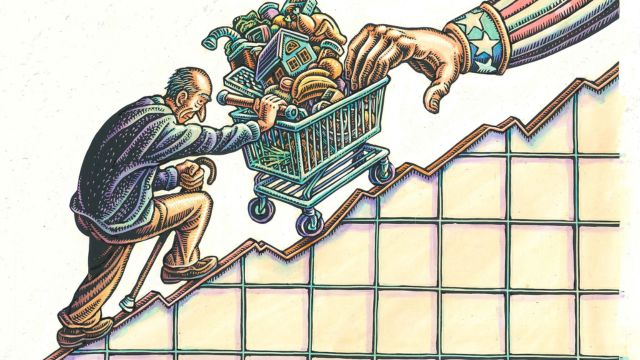

Experts are increasingly concerned that Social Security benefits are not rising with inflation, which may negatively impact retirees who primarily rely on it for their income. Washington’s Congressmen are debating the suggested modifications to Social Security to resolve this urgent matter.

Proponents of Social Security Revamp: CPI-E to Increase Retiree Benefits

The Urban Wage Earners and Clerical Workers Consumer Price Index (CPI-W) is the basis for the most recent changes to the Cost-of-Living Adjustment (COLA). Those who disagree contend that this index, which shows how much people spend when they’re employed, may not accurately represent the expenses that retirees bear. To address this disparity, some lawmakers are in favor of the Consumer Price Index for the Elderly (CPI-E), which takes into account the spending habits of individuals 62 and older.

Experts who point out that this age group comprises over 85% of Social Security beneficiaries endorse the decision to utilize the CPI-E. The CPI-E allocates higher weight to spending categories that are critical for senior citizens, such as housing and healthcare, and less weight to those that are less vital to retirees, including transportation, tuition, and food and drink. If these suggested Social Security reforms had been implemented during the preceding ten years, the average retired worker could have received an additional $2,689 in payments.

Social Security 2100 Act: An Audacious Plan to Increase Retirement Benefits Faces Budgetary Obstacles

A more extreme approach, as stated in the Social Security 2100 Act, would calculate COLAs annually using the higher of the CPI-W or CPI-E. By using this method, COLAs may rise by 0.3 percentage points on average per year. Had this approach been used ten years ago, retirees might have received a 4.4% increase in benefits or an additional $3,788 in their pockets.

It’s important to remember, though, that although these proposed Social Security reforms seek to address worries about benefits not keeping up with inflation, the actual adjustment of the COLA formula is unlikely to occur anytime soon. There are financial difficulties facing the Social Security program; the trust fund for Old Age, Survivors, and Disability Insurance (OASDI) may run out in the next ten years. Legislators must overcome these budgetary obstacles before making substantial adjustments to benefit calculations.